The Keys to Building Wealth

Only a few fundamental principles come to mind when I think about what it takes to create personal wealth. Like the 10 Commandments, they are simple but not necessarily easy to follow. To follow them requires consistent discipline, patience, and a long-term mindset. Here are the keys to building your wealth over time:

- Delayed Gratification: It is the ability to resist the temptation of immediate rewards to achieve greater rewards or goals in the future. Certianly the most difficult. Stragies I use to help with delaying gratification will be the subject of a later article.

- A High Savings Rate: It enables you to defer a higher portion of your income for future use. Starting out your savings rate is more important than your investment returns.

- Compound Interest: The process of earning returns on the initial amount saved and the accumulated returns from previous periods. It enables your current dollars to create more dollars in the future.

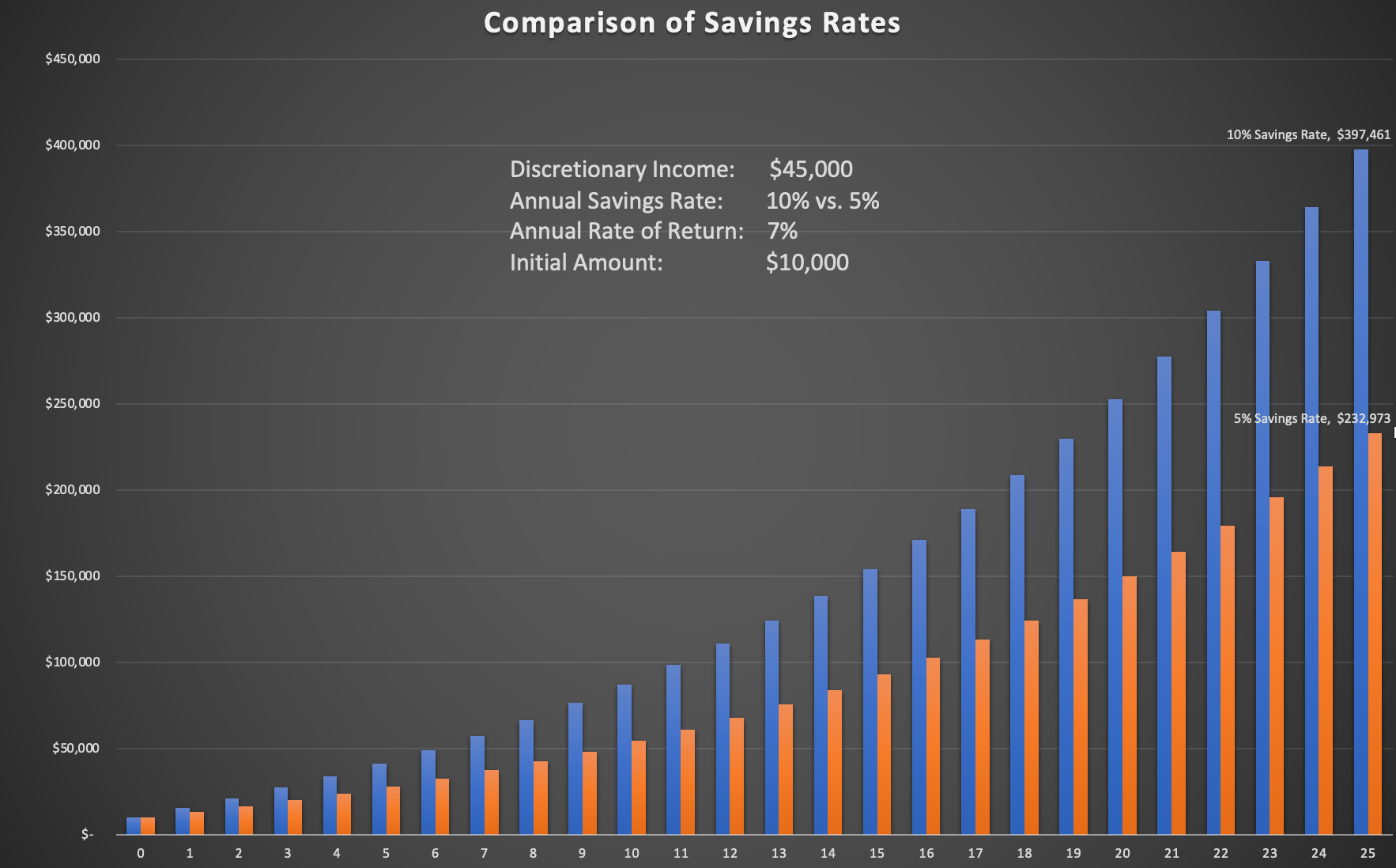

Here is a simple example to help you visualize these points.

Two people both have an after-tax income of $45,000 that never increases. At the end of every year, one person puts 10% and the other 5% into a retirement account which averages 7% per year over 25 years. As seen below, even though the investment return was the same, the person who saved only an extra $2,250 per year ended up with $164,488 more after 25 years. The large difference in the results is due to the years the extra savings had to compound for the person that put away 10%.

Just for reference the annualized return on the US Stock Market (including dividends) from 1923 to current has been 10%.

The key takeaway for me is that to an extent your behavior plays a greater role in your financial outcomes than investment selection since all public equities have a strong correlation. You should also focus on increasing your income over time instead of saving a few dollars on a coffee. A higher income allows you to increase your savings rate to be able to take more advantage of compound interest.

Below is the Excel sheet I made for the comparisons. Feel free to download and share with a friend. The inputs are in light blue.

The opinions expressed are for informational purposes only and should not be considered advice; individual circumstances may vary, seek professional guidance before making any financial decisions.