Is Gold a Good Investment?

Pros

- Gold is considered a safe haven asset during economic uncertainty and market turbulence as well as an inflation hedge.

- Historical performance shows that gold can mitigate tail risk during stock market reactions to unforeseen events like the pandemic.

- Gold has retained its value and served as a store of wealth for thousands of years, demonstrating its longevity as an asset.

Cons

- The lack of dividend or interest payments can make it difficult for investors to hold on to gold during periods of underperformance versus stocks, bonds, and other asset classes.

Recent Performance

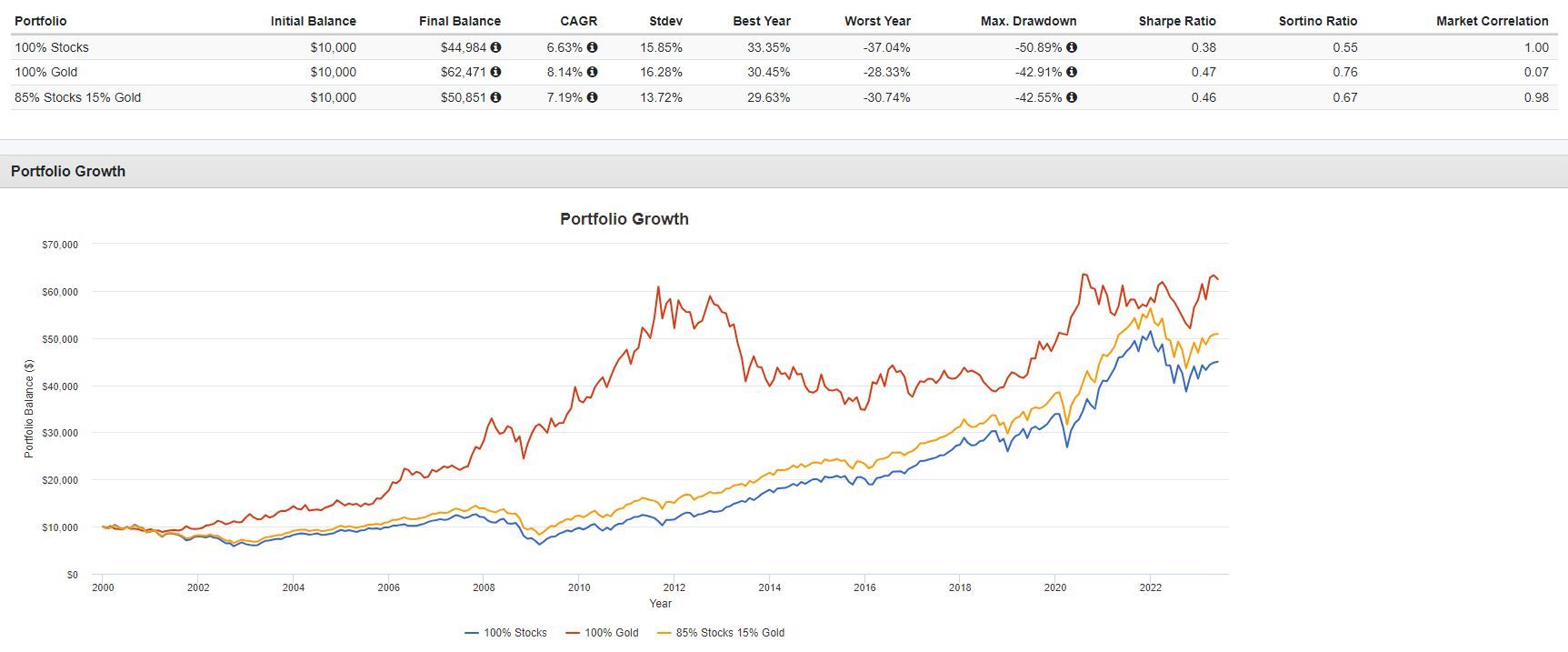

- From 2000 to 2023, gold has outperformed the US Stock market with close to zero market correlation. However, most investors would not be willing to sit through lengthy periods of underperformance versus the index, such as from 2012 to 2021.

- The performance of the 85% Stocks 15% Gold portfolio shows the benefits of having part of your portfolio allocated to gold. This example portfolio has provided better risk-adjusted returns and a greater absolute return over a 100% Stock Portfolio over the last 22.5 years.

Source: https://www.portfoliovisualizer.com

Takeaways

As a starting point most financial advisors will recommend allocating around 5% of a diversified portfolio to gold or other precious metals. This allocation provides downside protection and diversification benefits without significantly impacting overall portfolio returns. A simple way to get exposure to gold is through ETFs such as GLD and GLDM.

The opinions expressed are for informational purposes only and should not be considered advice; individual circumstances may vary, seek professional guidance before making any financial decisions.